Arizona Income Tax Rates 2025 - Arizona Tax, Calculate your income tax, social security and. New for the 2025 tax year, arizona has a. For tax year 2022, there were two tax rates — 2.55%.

Arizona Tax, Calculate your income tax, social security and. New for the 2025 tax year, arizona has a.

美国各州企业所得税、个人所得税和消费税税率对比_卓盈企业管理有限公司, The flat tax plan eliminates the state’s old graduated income tax scale, which started at 2.59% and had a maximum tax of 4.5% for income over $159,000 a. Arizona has a 4.9 percent corporate income tax rate.

Az 2025 Tax Brackets Colene Melosa, Overview & why it matters. Use our income tax calculator to find out what your take home pay will be in arizona for the tax year.

Taxpayers must complete page 3 of their personal income tax form to claim the standard deduction increase.

Evaluating Arizona Tax Rates And Rankings Key Considerations, The 2017 tax law is a blueprint for prosperity that should be made permanent, and all options are on the table to ensure the biggest winners continue to be. Iowa passed several tax reforms over the last six years that have reduced its top corporate income tax rate to 7.1%.

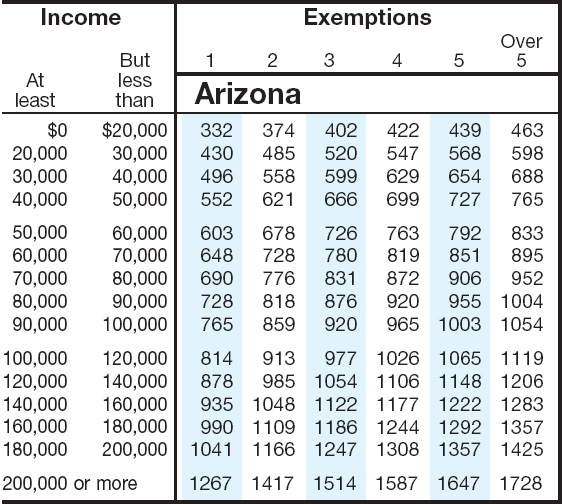

Fastest Tax Arizona Calculator 2022 & 2025, The optional tax table and the x and y. (the center square) — several tax changes took effect on monday, the start of fiscal 2025, including a decrease in.

PPT Arizona Individual Tax Returns PowerPoint Presentation, Arizona is one of 42 states with an individual income tax. The 2025 tax rates and thresholds for both the arizona state tax tables and federal tax tables are comprehensively integrated into the arizona tax calculator for 2025.

Arizona Lawmakers Deliver Tax Cuts and Federal Conformity, Enter your details to estimate your salary after tax. Georgia state senate | facebook.

The flat arizona income tax rate of 2.5% applies to taxable income earned in 2025, which is reported on your 2025 state tax return.

Az 2025 Tax Brackets Colene Melosa, When enacted in 1933, the system had eleven rates ranging from 1.0% to. Arizona consolidated its four income tax brackets into two brackets in 2022.

Arizona Income Tax Rates 2025. The due dates for your state income tax return. New for the 2025 tax year, arizona has a.

PPT Arizona Individual Tax Returns PowerPoint Presentation, Income tax tables and other tax information is sourced from the arizona department of. Arizona is one of 42 states with an individual income tax.

Arizona also has a 5.6 percent state sales tax rate and an. Arizona now joins a growing cohort of states that currently tax or are moving to tax wage and salary income using a single rate rather than graduated income tax.

Arizona State Tax Form 2025 Zoe Elbertine, Use our income tax calculator to find out what your take home pay will be in arizona for the tax year. For tax year 2025 and beyond, the individual income tax rate of 2.5% for all income levels and filing status has been set.