Fsa Plan Limits 2025 - Harvard Summer School 2025. Applications to study abroad through harvard summer school in summer 2025 open on december 6, 2025. Mentored research projects and presentation of. Explore and register for extension school and summer school courses offered through harvard division of continuing education (dce). Our courses are offered in a variety of flexible formats, so […] Fsa Limits 2025 Emmye Iseabal, The latest mandated fsa employee contribution limits on how much employees can contribute to these accounts is shown in the table below. What to know about fsas for 2025.

Harvard Summer School 2025. Applications to study abroad through harvard summer school in summer 2025 open on december 6, 2025. Mentored research projects and presentation of. Explore and register for extension school and summer school courses offered through harvard division of continuing education (dce). Our courses are offered in a variety of flexible formats, so […]

Insurance Treasurer's Office, Fsas only have one limit for individual and family health plan participation, but if you and your spouse are lucky enough to each be offered an fsa at work, you can each elect the maximum for a combined household set aside of $6,400. Here are the new 2025 limits compared to 2025:

IRS Announces HSA and High Deductible Health Plan Limits for 2025, Enhance exemption limits under the old regime the list is endless, but so are our wishes! But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

Updates Surency General, The 2025 maximum fsa contribution limit is $3,200. What to know about fsas for 2025.

The internal revenue service (irs) limits the total amount of money that you can contribute to a dependent care fsa.

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, Health fsa contribution limit the affordable care act (aca) imposes a dollar limit on employees’ salary reduction contributions to health fsas. An hdhp with an annual premium of $4,800 ($400 per month) and $5,500 deductible.

Tabela Atualizado Irs 2025 Hsa Imagesee vrogue.co, This is up from $3,050 in 2025. For the 2025 plan year, employees can contribute a maximum of $3,200 in salary reductions.

These limits undergo annual adjustments to account for inflation. What to know about fsas for 2025.

The annual limit on employee contributions to a health fsa will be $3,200 for plan years beginning in 2025 (up from $3,050 in 2025).

Eligible specialty crop growers can apply for assistance for expenses related to obtaining or renewing a food safety certification.

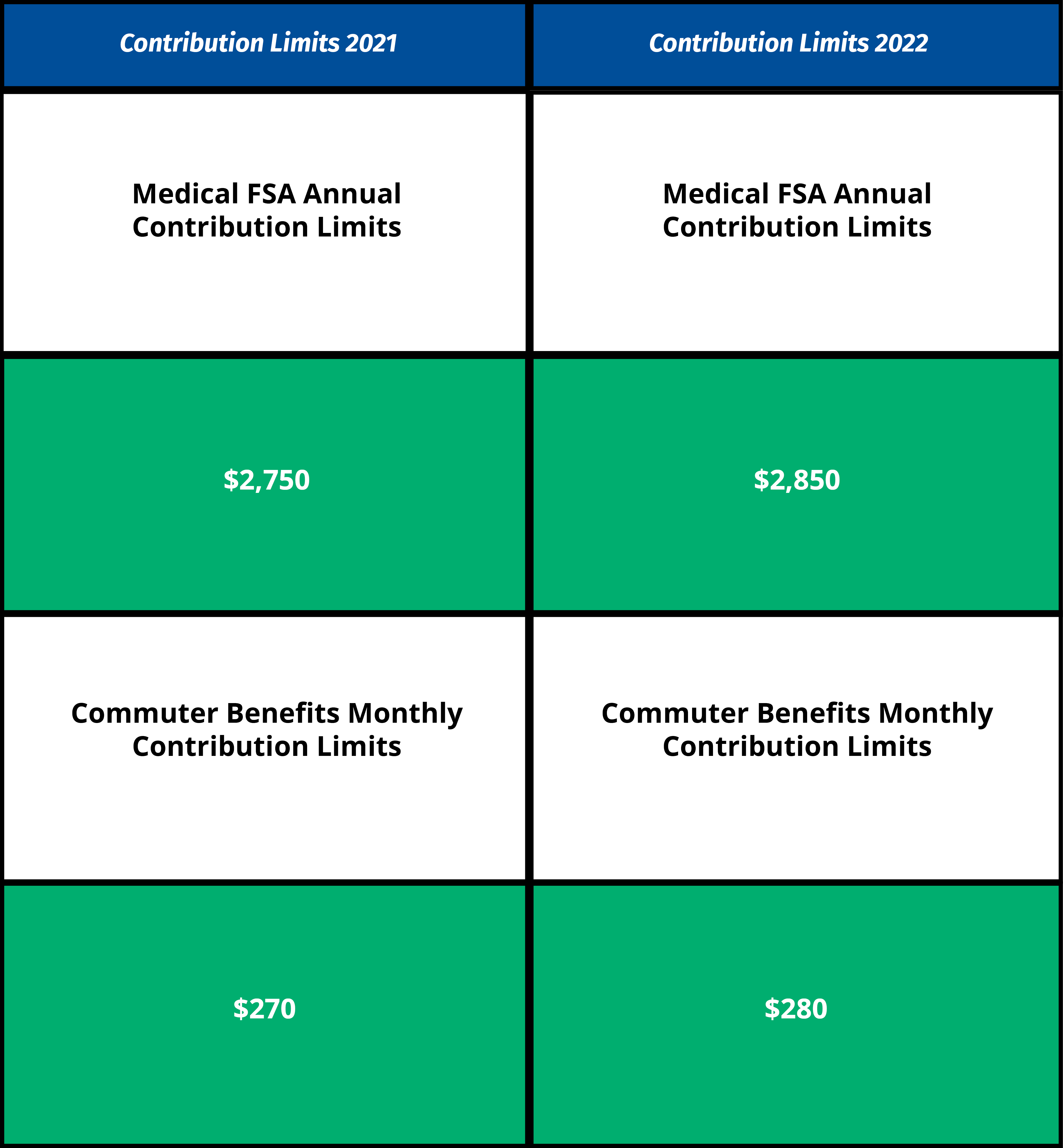

Here’s what you need to know about new contribution limits compared to last year.

Cogic Aim Convention 2025. Friday, july 7, 2025 9:00 pm. Jmd band preparing for the 2025 aim holy convocation! This equals 2 hours 25 minutes. Join us for our 2025 aim convention, taking place at lighthouse worship center cogic in ft.

What Is The Max Fsa Contribution For 2025 Wendy Joycelin, The 2025 maximum fsa contribution limit is $3,200. A ppo with an annual premium of $7,200 ($600 per month) and a $1,200 deductible.

Irs Flexible Spending Account Limits 2025 Halie Maddalena, Amounts contributed are not subject to federal income tax, social security tax or medicare tax. But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

Irs Fsa Contribution Limits 2025 Paige Rosabelle, Our bulletin breaks down the 2025 health fsa contribution limits issued by the irs for health plan sponsors and plan participants. 1, 2025, the contribution limit for health fsas will increase another $150 to $3,200.

Copa America 2025 Schedule Pdf Download Google. Lionel messi, and defending champions, argentina, will face the other fifteen teams with might and determination. Everything you need to know about copa américa can be found in this definitive guide. Uruguay vs colombia (8pm et, bank of america stadium, charlotte) Thu, jul 4, 2025, 3:15 am pdt […]

Fsa Plan Limits 2025. A rollover limit is a cap on any unused fsa funds from the previous plan year that can carry over into the next year. The irs has just announced updated 2025 fsa contribution limits, which are seeing modest increases over 2025 amounts.

2025 Fsa Contribution Limits Irs Tiffy Tiffie, The internal revenue service (irs) limits the total amount of money that you can contribute to a dependent care fsa. An hdhp with an annual premium of $4,800 ($400 per month) and $5,500 deductible.